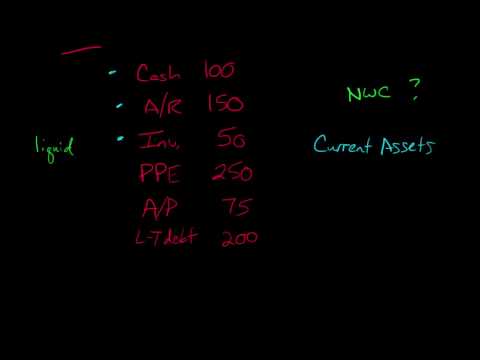

Analysts and investors frequently refer to something called networking capital or working capital. Working capital is basically the current assets of the firm minus the current liabilities. This calculation is not required to be reported in the financial statements, but it is a measure of liquidity. It gives us an idea of how well the firm is able to meet its current obligations with existing resources. Current liabilities act as a gauge for these obligations. We use current assets such as cash, inventory, and accounts receivable to determine the firm's liquidity. If the firm is unable to meet these obligations, they may need to raise outside capital. Let's take a quick example to calculate working capital. Suppose a firm has cash of 100, accounts receivable of 150, inventory of 50, property plant and equipment of 250, accounts payable of 75, and long-term debt of 200. We want to determine the firm's liquidity by calculating working capital. First, we need to calculate our current assets, which include cash, accounts receivable, and inventory. Property plant and equipment is not a current asset and is not factored into the calculation. So, our current assets are 250 + 150 + 50 = 450. Next, we need to calculate our current liabilities, which include accounts payable. Long-term debt is not a current liability and is excluded from the calculation. So, our current liabilities are 75. To find our networking capital, we subtract the current liabilities from the current assets. Therefore, our working capital is 450 - 75 = 375. By calculating working capital, we can determine how liquid the firm is and whether they can meet their obligations or if they need to raise outside capital. This provides us with a measure of liquidity for the firm.

Award-winning PDF software

Schedule M 2 retained earnings worksheet Form: What You Should Know

Note: In general, retained earnings are assets that have been retained. In cases where retained earnings are not yet included on the books due to deferred accounting, such as in cases where the Corporation plans to distribute the net earnings in a later year and the net earnings are still to be included on the beginning of the year, the Corporation may be required to file Schedule M-3 (see instructions). The purpose of Schedule M-2 is to reconcile the Corporation's unappropriated retained earnings account as found on the beginning of the year Note 2 (a). On the beginning line on the 1120S-US, line 13 is the accumulated adjustments account (AAA) and line 11 contains a reconciliation of the AA/AE to retained earnings. Since all adjustments to the AA/AE must be included on balance sheets, and the AA/AE account must account for all changes in the corporation's income, the AA/AE reconciliation is usually the most complex in terms of items to be included in the statement of earnings, because of the complexity involved in reconciling certain items to the AA/AE. 2. The remainder of the 1120S-US worksheet: 1. The remainder of the 1120S-US contains the consolidated line 13 (AAA) on line 11 and a reconciliation of the AA/AE to retained earnings as shown below. The AAA and the AAA reconciliation are the same. 3. Note 3 (b). If all the adjustments for the AA/AE have been fully reconciled, and the corporation's taxable income for the year is greater than zero, then the AAA on line 11 will have a zero line. If less than 80% of the corporation's adjustments have been fully reconciled, then the AAA on line 11 will have a zero line. Note 4 (c). All adjustments to the AA/AE account must be included as taxes reported on the income statement and the Corporation must make appropriate adjustments to its adjusted retained earnings account if all the AA/AE adjustments have been included on the books. If the corporation's Adjusted Retained Earnings account has been subject to adjustment for tax purposes, the corporation also should make appropriate adjustments to the AAA. The AAA must be made as a result of tax payments and the Corporation may elect to include additional adjustments to the AAA as a result of tax payments. The amount that will be added to the AAA in a tax year is generally reported on line 8 (refer to IRS.10.1.2.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-F - Schedule M-1 & M-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-F - Schedule M-1 & M-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-F - Schedule M-1 & M-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-F - Schedule M-1 & M-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule M 2 retained earnings worksheet